The Greatest Guide To Tinkham Real Estate

Wiki Article

The Facts About Tinkham Real Estate Revealed

Table of ContentsMore About Tinkham Real EstateThings about Tinkham Real EstateExcitement About Tinkham Real EstateTinkham Real Estate Things To Know Before You BuyGetting My Tinkham Real Estate To Work

You may also have a hard time to discover sufficient renters to fill up that office structure or retail facility you purchased. Home Flipping Investors who intend to make cash quickly typically count on house flipping. This is when you buy a residence for a lower cost, remodel it quickly and also then sell it for a fast revenue.You're not curious about month-to-month leas when flipping a home. Instead, you require to buy a house for the most affordable possible rate if you want to make a good profit when selling. Once more, research study is essential. You wish to locate a home in an eye-catching area, one that brings in lots of buyers.

Expanding your investment profile is necessary. If you put all your eggs in one basket, you could suffer a failure in the blink of an eye. However when you spend some funds in the stock exchange, various other funds in bonds or ETFs, and some in realty, you boost your chances of greater profits and also fewer losses.

See This Report on Tinkham Real Estate

Allow's state you located a residence for $100,000; if you put down $10,000, chances are you might discover a funding to fund the remainder as long as you have great credit history as well as secure earnings. With that, it implies you spend simply 10% of the property's value and possess it.

Unlike supplies or bonds, you can compel the realty to value. It seems strange, but it's possible. Understand that actual estate values naturally. On average, real estate appreciates 3% 5% a year without you doing anything other than maintaining the house. You can raise the price of appreciation by making improvements or repairs.

You will not get a dollar-for-dollar return on your financial investments, yet some restorations can pay you back as high as 80% 90% of the cash invested. The restorations don't have to be significant either. Of program, adding an area or completing the cellar will add even more value than simple cosmetic restorations, however even minor bathroom and kitchen restorations can considerably affect a home's well worth.

Fascination About Tinkham Real Estate

Yet, while it's an investment, when you own a home and rent it out, you run an organization you are the property manager. As the business owner, you can usually compose off the following expenditures: The mortgage interest paid on the lending Source points paid on the financing Upkeep expenses Devaluation (expanded over 27.When you invest in supplies or bonds, you can just write off any type of funding losses if you offer the property for less than you paid for it. They not only checklist available investment houses for sale, however numerous of them have renters with leases in place currently. Roofstock likewise uses lots of due diligence, researching you, so all you have to do is get the home you assume is best.

Without risk, there can't be an incentive. There's not much to feel safe concerning when you buy the marketplace. However, as 2020 revealed, it can change helpful site in the blink of an eye. One min you have a significant investment, as well as the following, you've lost whatever. When you purchase actual estate lasting, you know you have an appreciating asset.

More About Tinkham Real Estate

Numerous people purchase actual estate to supplement their retirement revenue. Whether you own the property while you're retired, gaining the month-to-month rental capital to supplement your revenue, or you market a home you've owned for several years when you remain in retired life as well as earn a profit, you'll increase your retired life income.If buying property as well as leasing it out is as well stressful for you, there are numerous other methods to invest in property, including: Purchase an undervalued residential or commercial my sources property, repair it up as well as flip it (solution and flip) Be a dealer working as the middle man in between motivated vendors and a network of customers.

Purchase a Property Investment Trust fund If you intend to leave a heritage behind but don't think going cash is a great idea, passing genuine estate down can be also much better. Not just will you offer your heirs an income-producing possession, yet it's also a valuing her response possession. So they can either keep the building and also allow the legacy proceed or sell it and make revenues.

Allow's claim you have $50,000 equity in a home. You can refinance the home loan on it, take out the $50,000, and use it as a deposit on your next property. Depending upon the value of your residential properties, you might even have the ability to pay cash money for future properties, enhancing your profile and also the equity in it also much faster.

The smart Trick of Tinkham Real Estate That Nobody is Discussing

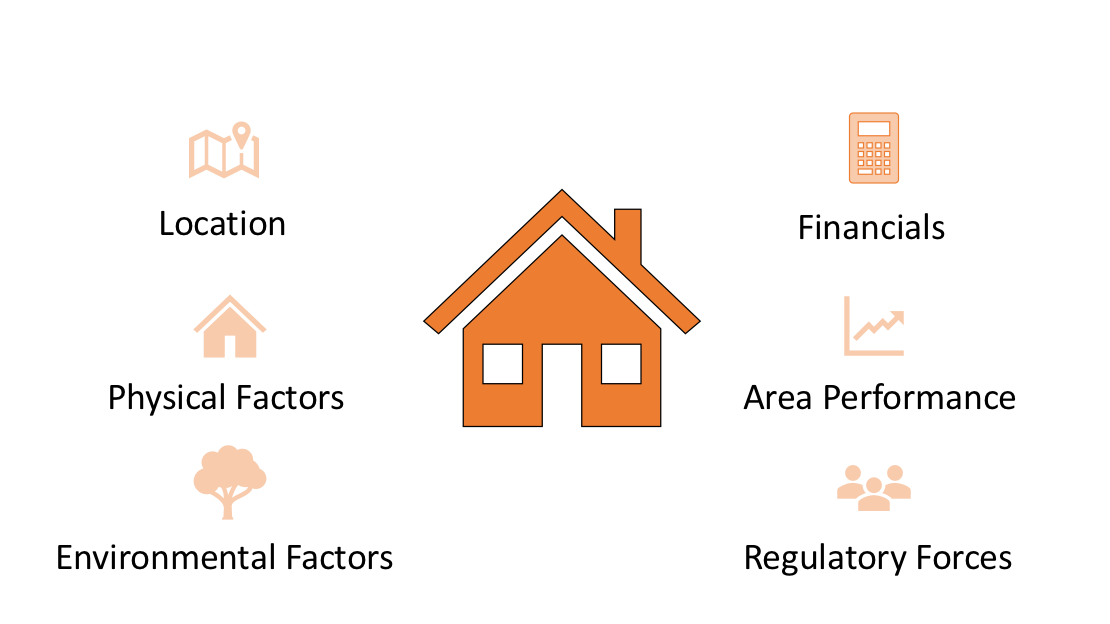

While there's not a one-size-fits-all answer, there are certain characteristics to seek when you buy property, including: Look for an area that's attractive for tenants or with fast valuing homes. Ensure the area has all the amenities and benefits most home owners desire Consider the location's crime rate, institution rankings, and tax obligation history.Report this wiki page